What Is Statutory Income Australia

Thus amounts derived in similar circumstances would be included in assessable income via the statutory income provisions.

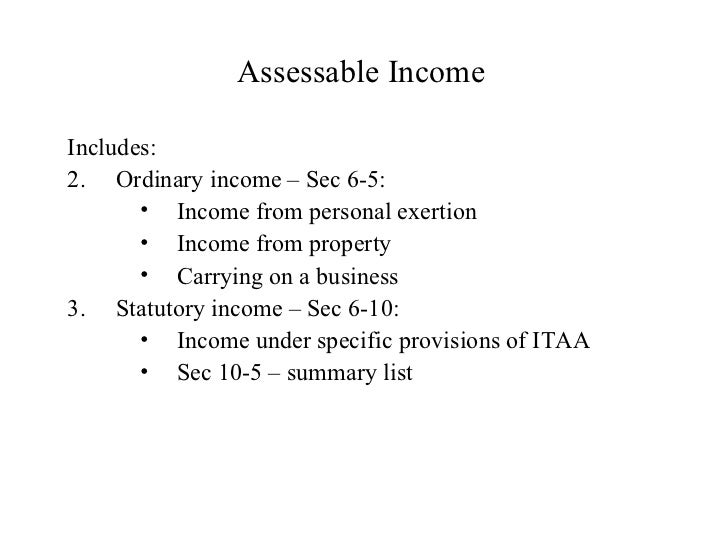

What is statutory income australia. Taxable income is the difference between assessable income and allowable deductions. Section 10 5 of itaa 1997 accessible from the ato website includes a table which specifies the sections which include statutory income in assessable income. Statutory income are amounts outside the ordinary concepts of income that have been specifically included in assessable income. Strict accounting standards apply and the figures are subject to independent audit.

The former is gradually being re written into the latter. Statutory figures are those presented by the company in their formal company reports. 2 amounts that are not ordinary income but are included in your assessable income by provisions about assessable income are called statutory income. Statutory income is income that is not ordinary income and that you include in assessable income because of a specific rule in the tax law.

For example a net capital gain is statutory income. All information contained in this publication is summarized by kpmg australia pty limited the australian member firm affiliated with kpmg international cooperative kpmg international a swiss entity based on the australian income tax rates act 1986 superannuation guarantee charge act 1992 and the superannuation guarantee administration act 1992 medicare levy act 1986 and income. S6 5 commission receivedstatutory income statutory income are amounts outside the ordinary concepts of income that have been specifically included in assessable income. Statutory income is an amount the law specifically includes in assessable income for example section 160zo of the income tax assessment act 1936 includes net capital gains in assessable income.

They include all items and costs that impact profit income statement financial position balance sheet and cash flow cash flow statement. Examples of statutory income include capital gains dividends and franking credits any allowances and redundancy payments see section 10 5 of the income tax assessment act 1997 cth. It is derived form specific sections. The two statutes under which income tax is calculated are the income tax assessment act 1936 and the income tax assessment act 1997.

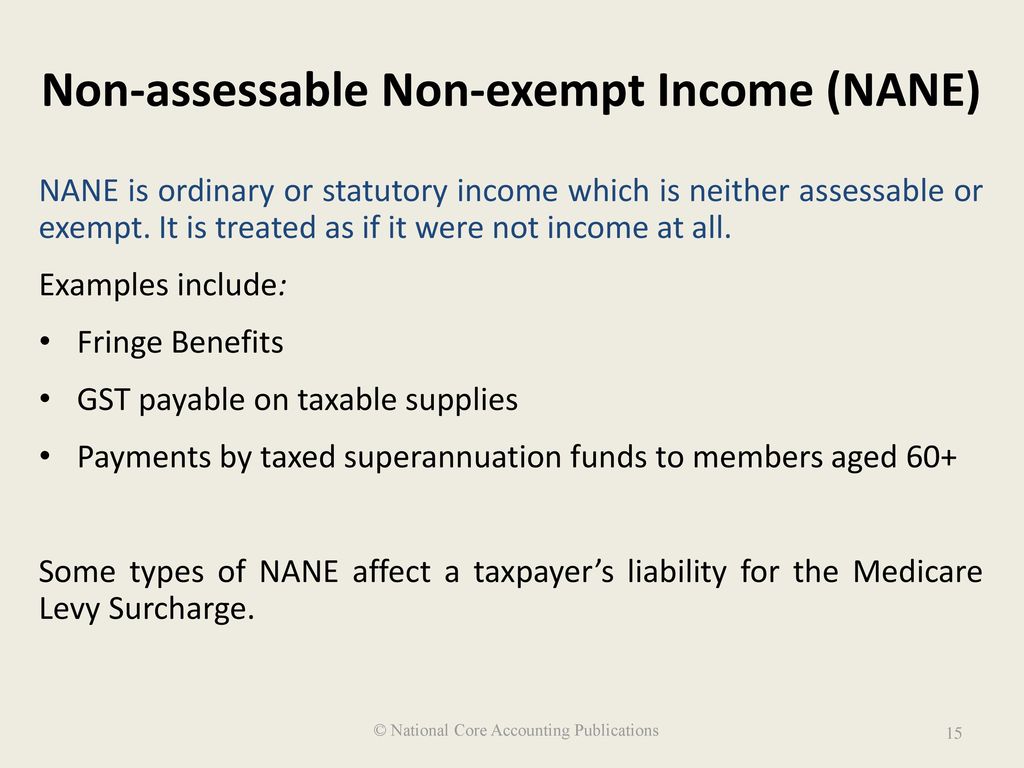

Statutory income referring to all amounts that are not ordinary income but are included in your assessable income by way of a specific rule in tax law. Income from personal exertion eg. There is generally considered to be three components of ordinary income. Salary and wages income from property eg.